Securing funding for your startup is a challenging exercise that frustrates even the most experienced founders — especially if you’re comparing yourself to the “overnight” success stories in TechCrunch.

Luckily, in 2022 there are many options for startup founders to access growth capital, even if you only have an idea!

We want you to have the best possible chance at securing funding for your startup. That’s why we’ve created this straightforward guide to the different startup funding options in the UK.

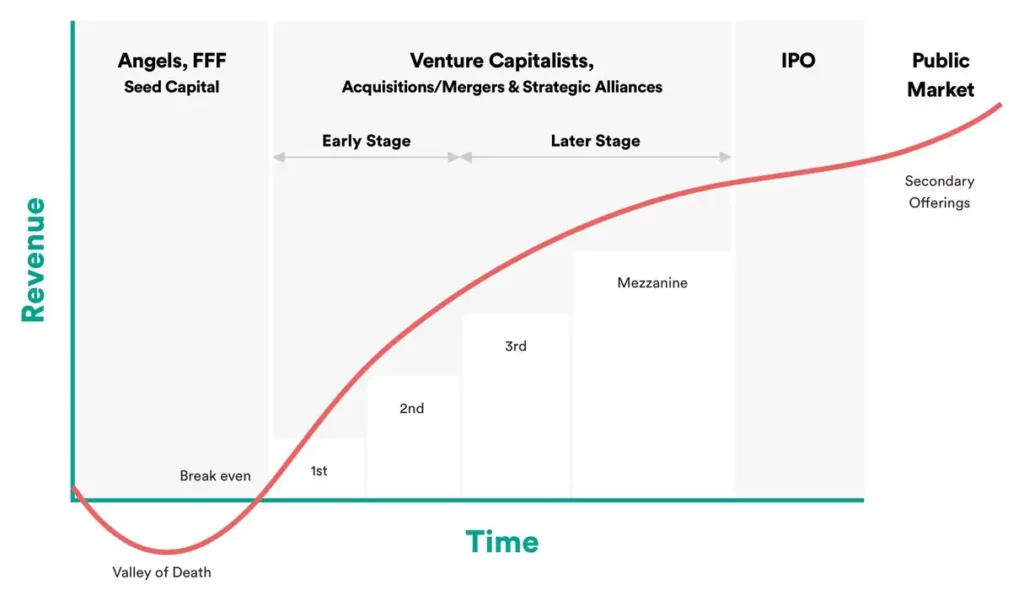

How startup funding works

Startup funding comes down to one thing and one thing only…. Capital. Capital is the money that your startup needs to operate and grow.

The first step in knowing how much capital you will need to raise is knowing how much it is going to cost to bring your idea to life, what kind of revenue you might be able to generate — and whether the market you’re targeting is going to be big enough to turn your idea into a profitable venture.

Your future revenues, potential profits, and the costs of delivering this can be combined to estimate the value of your startup.

This valuation informs the price of shares that you may be selling for capital. How to sell those shares is totally up to you. Let’s have a look at what pathways to funding are available for startups in the UK.

An overview of different funding routes

There are many ways to secure funding for your startup. Each one has its pros and cons. We’ll take a quick look at the definitions of each pathway to funding before exploring them in depth.

Bootstrapping

Bootstrapping means keeping the founders as the only shareholders in your startup. You hold all the equity and control all the decisions. It’s unlikely to surprise you that most startups begin life bootstrapped.

Equity funding

When you sell shares in your business, this is called “equity funding”. This means that investors purchase a share of your company in exchange for voting rights and an agreed portion of your profits and losses.

Crowdfunding

Your startup is crowdfunded when a large group of individuals or groups invest capital in exchange for rewards. Crowdfunding usually happens on major platforms. Investors who participate in crowdfunding usually never have in-person meetings with the founders.

Government subsidies and grants

A grant is capital awarded to your business that doesn’t have to be repaid. Grants are awarded to assist your startup in its development.

A subsidy is a sum of money or tax reduction provided by the government. Subsidies are usually awarded to relieve a specific burden or to promote something in the public interest.

Both grants and subsidies are usually awarded for a predetermined industry or business sector.

Debt financing

It’s also possible to fund your startup through loans. Debt financing provides capital loans that your business has to pay back to investors, usually with interest.

Revenue-based financing

You can also secure loans for your startup based on how much revenue you have made in the past. Being approved for revenue-based financing means that banks and lenders evaluate how long it will take your startup to repay a loan

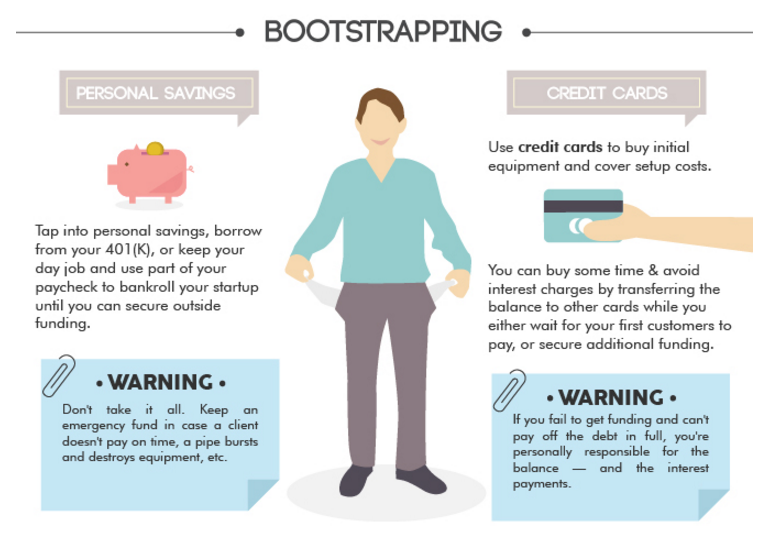

Bootstrapping

Bootstrapping is exactly what it sounds like— directly investing your own money and resources for your start-up. It’s based on the common expression: pulling yourself up by your own bootstraps.

Essentially, you’d only have the resources that you bring to the table. So if you have money or sweat equity to spend on your start-up, can bootstrapping be effective?

Major startups like Braintree and BigCommerce are bootstrapped. The founders began by investing their own money as capital.

One thing that founders of bootstrapped companies share is the desire to own 100% of their company, without having to answer to external investors.

When to bootstrap a startup

If it’s important that you and your co-founders own 100% of your startup, then bootstrapping is for you. Some founders want to avoid external input into their startups, and that’s perfectly normal.

Unless you’re one of the lucky few, almost every startup begins bootstrapped. As the founder you’re expected to take on the early risk before you have any revenue, or even launched your product. You will be investing your own money, time, and resources into the business.

If you achieve early traction by selling your products or services then you might never need external funding. You simply reinvest the revenue from sales to create capital in your business.

The best part about bootstrapping is that it provides undeniable proof of demand. This means that you have confirmed that your product has a solid product-market fit, can generate stable revenue, and is profitable.

Should you wish to have investors in the future, having proof of demand and product-market fit will make your startup extremely attractive.

When you shouldn’t bootstrap a startup

If you’re entering a market where your competitors are venture-backed, you may want to consider other methods of funding. Unless, of course, you have the available capital and expertise to match their valuation. If not, you’re just bringing a knife to a gun-fight.

Bootstrapping may also be challenging if you don’t have expertise in the industry. You may need to hire someone who is licensed or an expert to contribute time and effort into helping you to develop your company, increasing your burn-rate. Of course, you could bring them on as a co-founder and bootstrap the venture with your shared expertise!

Equity Funding

Funding your business by selling shares is a good strategy if you’re willing to share profits, loss, voting rights, and risk with your investors.

Equity funding is usually done when a startup offers investors a high-risk/high-reward outcome. This means the company is ready to grow in some way.

It’s important to find investors who are passionate about your industry and your startup. These investors will be genuinely interested in the success of your company. As you grow together, these relationships will strengthen and you will be able to make quality decisions at a faster pace.

Let’s have a look at the types of investors who can best participate in equity funding for your startup.

Friends and family (and fools)

Raising money from friends and family can be a blessing and a complication. The optimal situation to request funding from friends and family is when you are bootstrapping. If you don’t have all the money, and have invested your own resources as capital, you can call on them for assistance.

This can be good as your friends and family know you well, and are likely to be more flexible with repayment. Plus, they unlikely to have the same due diligence demands as venture capitalists and other professional investors.

In the investment world, this type of funding is called ‘Friends, Family & Fools’.

There are high risks of receiving funding like this. One risk is losing your close relationships because things didn’t go as planned. It’s also risky when you aren’t aware of your valuation. You could be selling them too much equity in your startup.

Finally, there’s always the possibility that they will ask for their money back if your startup doesn’t work out. That’s something that a professional investor would not do.

Angels & angel syndicates

Business Angels are typically individuals with high net-worth who want to invest in new startups. In the UK, Angel investors usually invest through government programs like EIS/SEIS (for further information on SEIS and EIS check out this guide by SeedLegals).

Angel investors tend to invest less money than venture capital funding. The benefit of this is they will be less hands-on as your company grows. They usually come in to help your startup grow at the very beginning.

Pre-Seed (Early Seed)

For most founders on the venture capital route, pre-seed (or early seed) is first step on the path when raising equity funding for your startup.

At this stage you won’t have a proven business model or working product, but you’ll have made good progress towards proving that there is a venture-scale market opportunity and enough demand for your idea (this is traction!).

If you have a strong founding team and can demonstrate traction then you might not need anything else to close a pre-seed round. Investors will be willing to take larger risks that allow you to test your model and prove your market before you complete your product.

Pre-seed investors will usually include three components: capital investment (obviously), mentorship, and a network of valuable connections to potential customers or partners.

True “value-add” investors will bring more than just capital to the deal. When you’re at the earliest stages, it can often be the access to networks that unlocks your growth potential and helps your startup to succeed.

Seed

Seed funding is one of the first investments made to help your startup move from product concept to product implementation.

This round of funding is usually led by specialist early-stage VCs, though some angel investors will also be involved. Seed investment in the UK has traditionally been around 2 million pounds, though this seems to increase every year. Seed investments can be used for working capital, marketing, property, research, business development, or other growth needs.

Seed funding has benefits for both you and your investors. Your company gets a chance to deliver on your growth targets using a substantial amount of capital. Investors will benefit from the proof points you will have achieved over previous rounds, derisking their investment while still having the potential for a high returns.

Pre-Seed & Seed Investors in the UK

- 7Percent Venutures

- Amadeus

- Antler

- Ascension Ventures

- Connect Ventures

- Founders Factory

- Forward Partners

- Fuel Ventures

- Haatch

- Hoxton Ventures

- Index Ventures

- LocalGlobe

- Octopus Ventures

- Parkwalk Advisors

- Pi Labs

- Playfair Capital

- RLC Ventures

- SFC Capital

- Stride.VC

Series A

If all is going well, your Series A funding will come around 18 months after you successfully closed your seed round(s). You’ll now be dealing with institutional investors and much larger amounts of capital.

Closing a Series A round is a major milestone for a startup. It shows that you have achieved strong indicators of product-market fit and have demonstrated that there are scalable acquisition channels to reach new customers.

Series B

In Series B funding rounds, your company would sell preferred shares that do not provide its holders with voting rights. Instead, those preferred shares come with a convertibility option. This means the investors who buy the preferred shares can choose to convert their shares into common stock at a later time.

Venture capital firms usually lead Series B rounds. The purpose of a Series B round is to provide your startup with funding for:

- new hires,

- purchasing equipment,

- forming and solidifying business options to take on more customers,

and other business development activities. The goal of a Series B round is to become more attractive to larger investments in a Series C round and beyond.

Series C and beyond

When your startup has stable revenue streams, with a proven history of growth, you’ll be ready to raise your Series C funding round. At this stage of funding, your customer base needs to be strong and reliable over time.

Series C funding is for companies who want to expand their operations to have a global impact and reach. Startups participate in Series C funding to make the company appealing for acquisition, or to support a public offering. Series C through G and beyond are usually referred to as ‘late-stage investments’.

Sources that provide funding for Series C startups include:

- Private equity firms

- Hedge funds

- Banks and private lenders

- Late-stage venture capitalists

Crowdfunding

Crowdfunding can be a perfect option for your product-based start-up. Crowdfunding can also double as a marketing tool for your business, since it reaches a large group of people. There are four main types of crowdfunding:

- Donation-based: people give money towards a specific cause, individual, or organisation without expectation of any returns.

- Pre-payment or rewards-based: individual people or groups pay to preorder a product, or receive a particular service or reward.

- Loan-based: also referred to as peer-to-peer lending (P2P), loan-based crowdfunding takes place when people lend to businesses in exchange for repayment and interest payments.

- Investment-based: people invest in businesses by purchasing equity or debt-based shares in the company.

Best platforms for crowdfunding

Crowdfunding is usually done on the Internet through platforms. These platforms facilitate the distribution of rewards, and give your company the ability to communicate with your investors through email newsletters, videos, posts, and updates.

Consumer vs. Equity crowdfunding

When your startup is entering the production phase for your product, you may want to offer consumer-focused crowdfunding. This will allow you to pre-sell units of your product and deliver it to your ideal customers.

Equity crowdfunding allows groups of people to buy shares in your business online. You may want to offer this type of funding if your startup is service-based or just entering the planning phase.

Crowdfunding is competitive. There are many people in the marketplace, so it may cost a hefty amount of capital to advertise your product or service to crowdfunding investors.

Consumer-focused (reward-based) crowdfunding platforms

To participate in rewards-based crowdfunding, you’ll need to create a pitch. This pitch should explain what your product is, and how you will provide specific rewards if the company meets its funding goal.

The rewards you offer should be proportional to the funded amount. In many crowdfunding exercises, the reward is the final version of the product.

You will need to create and manage a page for your startup on crowdfunding platforms. Your investors will also require some form of reward in return for their pledge. This can be units of your product, exclusive content, and other creative offers.

Here are some platforms that can help you execute reward based-crowdfunding for your startup:

By partnering with Crowdcube, Crowdfunder also allows growing startups to receive equity funding.

Equity crowdfunding platforms

Equity crowdfunding is the perfect opportunity to gain investors who will do more than just buy shares in your company. Yes, they will invest money, but you can also ask them for valuable feedback and knowledge for your business.

These investors will become advocates who have a deep stake in your startup’s success. They will help to spread the word about your business, adding credibility and exposure.

Two main platforms in the UK for equity crowdfunding are:

Government subsidies and grants

The World Trade Organization defines a subsidy as any financial benefit provided by a government that gives an advantage to a business, industry, or person. This advantage includes reducing the cost of doing business. Subsidies come in many forms, including:

- Tax breaks: including exemptions, credits, or deferrals.

- Loan guarantees

- Government policies for procurement

- Stock purchases: the government buys stock to keep a company’s shares priced higher than market levels

- Cash subsidies: such as grants and research & development funding.

Getting a government grant or loan

A government grant is money that you don’t have to pay back, awarded to your business by the government. Grants aren’t usually allocated to start your business. They will always contribute to a specific project or initiative.

Government grants typically are given with conditions. These conditions state how you can spend or allocate the money.

A government loan for your startup comes with many benefits for businesses under 24 months old. Each director in your startup can take out a loan up to £25,000 per director. This loan has a fixed annual APR of 6%, with a 5 year repayment period.

Government loans also offer 12 months of mentoring, and a 6-month holiday on the repayment, to give your business time to build enough revenue to afford it.

Government funding for research and development

Right now, the UK government offers 17 funding schemes for research and development, including r&d tax credits. These funds include research grants and development grants to encourage individual small and medium-sized enterprises (SMEs) to develop.

Getting a research or development grant can help your startup to experiment with new ideas, and work collaboratively with higher education institutions, like universities.

Explore your government funding options

To explore more of your government funding options, you can visit these websites:

You can also use Swoop or Grantify to see your eligibility for a government grant, and to discover grants and loans that apply to your business.

Finally, you should ensure that you check the Innovation Funding Service frequently — it’s the where many R&D initiatives invite applications (mostly from Innovate UK).

Debt finance

Funding your business through debt financing means you receive capital that you have to pay back at a later time. Lenders charge interest, meaning that you will repay more than you received.

If you’re a founder who doesn’t mind incurring a healthy amount of risk for your startup, debt financing may work for you. Debt financing can support your business growth, after you’ve already started making stable revenue.

Small business loans

A business loan can help your startup fund large developments or get through financial difficulties. Your startup would borrow a set amount of money for an agreed term, which would then have to be repaid to the lender, with interest.

This lending term can be as short as one month, or much longer, like 30 years. There are 2 main types of small business loan:

- Secured: borrowing against your business assets such as machinery, shares, or property

- Unsecured: borrowing capital without borrowing against your business assets

Start Up Loan scheme

The British Business Bank offers loans up to £25,000 for new startups. This is part of the Startup Loan Scheme by the UK government. You must pass a credit check and be over the age of 18, in addition to other factors for eligibility.

They work with partners to help startups and new businesses with operations and documents like business plans and cash flow forecasts.

Invoice financing

Through invoice financing, your startup can borrow capital against the amounts due to be paid by customers. Invoice financing can help your startup pay bills, reinvest in your systems and development, and improve your cash flow.

Invoice financing is also referred to as “accounts receivable financing” or “receivables financing.”

Repayment of invoice financing happens when your startup pays a percentage of the invoice amount to the lender as a fee for borrowing the money. Invoice financing is useful for solving problems caused when customers take a long time to pay, and other issues associated with securing other credit lines for your business.

Instead of waiting for your customers to pay, you would borrow against their invoices to receive the immediate funding you need. This type of debt funding is best done in startups who sell to large companies.

Venture debt

Venture loans are a debt offering in which a fund lends up to 30% of the last round of venture capital raised by your startup. The terms of your venture debt agreement will be specific to your business.

Venture debt is offered by banks and other official lenders. Venture debt loans are designed to provide fast-growing, early-stage startups using venture capital backing. companies with venture capital backing.

If your startup needs new equipment during a growth phase, acquiring venture debt will reduce share dilution for the founders and investors, while providing the necessary capital.

Venture debt is a great funding option for startups which have succeeded in completing many rounds of raising venture capital. Startups like this would benefit by receiving the cash flow needed to help them to realize their market potential.

The US has over 100 venture debt lenders, while the UK has 16 venture debt lenders, and is still growing the market. You can use these resources to discover the right venture debt investors for your startup:

Peer-to-peer business loans

Peer-to-Peer (P2P) loans are a direct, personal way that you can borrow capital for your startup. Banks and other lending intermediaries are not involved in peer-to-peer lending.

P2P funding has no time-consuming procedures that make traditional bank loans difficult. The type of P2P loan your startup receives will differ, based on the type of company you have, and the type of investor lending the money.

Here are 3 online resources where you can discover peer-to-peer lending for your startup:

Funding Circle

Funding Circle directly connects investors to businesses with good credit, who wish to borrow capital. This benefits both the business and the investor.

Small businesses are able to borrow faster and easier than traditional methods, and investors can earn a return and help the business by lending to them.

Zopa

Zopa is the first P2P lending platform in the world. It allows investors to start buying shares for as little as 1000 pounds.

Rate Setter

If you’re bootstrapping your startup, Rate Setter offers personal loans so you can get started by borrowing capital.

Revenue-based financing

Funding your company with revenue-based financing means a bank or lender evaluates the financial history of your startup.

These lenders use data to analyse your projected income. Then, they decide whether they should approve your startup for a loan. Your revenue will determine the length of the loan term – meaning how long your startup has to repay the lender.

This is the fastest type of funding that can be completed in minutes. Another benefit is the vote of confidence that your company can and will repay this loan in the set amount of time. Should you apply for other types of funding, this will make your business attractive to investors.

Startup funding – which approach is best?

We’ve analysed all sorts of startup funding methods – from bootstrapping to revenue-based finance. But don’t forget that your startup is unique, as are your drivers for starting a new venture. It’s now up to you to focus on good decision-making and strategy to develop your business into its most successful form.

Choosing which route to fund your startup business depends on where you are now, where you want to be as a business and as a founder, and who your competition is. As your startup grows and evolves, you will learn many different techniques and lessons about how to negotiate the best funding for your business.